Continuing its mission

The onset of the COVID-19 pandemic in mid-March 2020 sent many businesses reeling. As the U.S. economy shut down, people were ordered to stay at home and economic chaos reigned.

For arc Thrift Stores, the shutdown was particularly devastating. As a projected $10 million in sales revenue dried up through the second half of March and April— the nonprofit learned it was ineligible for the Paycheck Protection Program (PPP). The federal relief effort rolled out within weeks of the pandemic declaration targeted small businesses juggling payroll and other expenses but its reach did not include larger nonprofit organizations.

Meet arc Thrift Stores

Founded: 1968

Leadership:

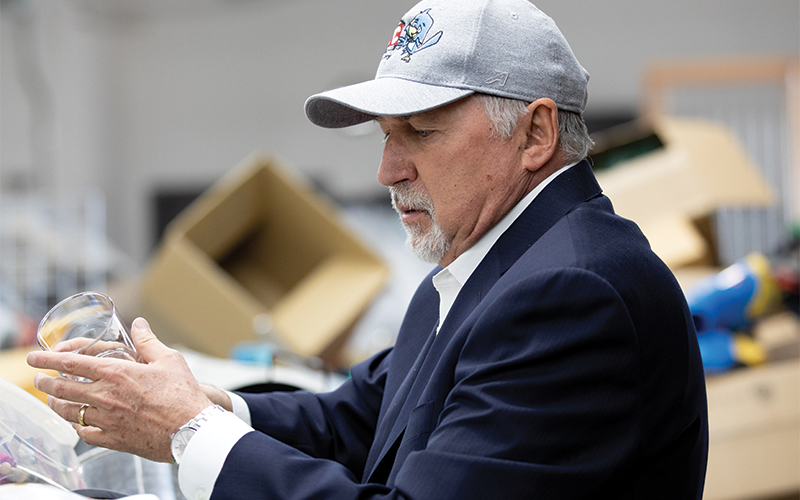

A 501(c)3 nonprofit since 2006, led by President and CEO Lloyd Lewis since 2005. Inspired to change his career focus, priorities and trajectory when his son, Kennedy, was born with Down syndrome in 2003, Lewis first accepted the CFO job because he believed his extensive business skills could be helpful for an organization dedicated to helping people with disabilities. Despite no previous experience in the retail industry, he has flourished as CEO, turning around a then-struggling operation and growing it to 34 stores by early 2023.

How he made his mark:

Lewis has led arc Thrift Stores’ mission-first retail store concept to becoming the largest supporter of advocacy efforts for people with

intellectual and developmental disabilities in Colorado. As of 2023, arc Thrift Stores employed more than 400 individuals with intellectual and developmental disabilities across its 34 Colorado stores. “I would hire these employees at any company as they love to contribute, they’re very positive and they inspire fellow employees,” Lewis said. “I attribute half of arc Thrift Stores’ success in its multiple years of record growth to their employment.”

During Llyod Lewis' tenure as president and CEO of arc Thrift Stores, the organization has:

- Provided more than $140 million in funding to The Arc of Colorado, a statewide advocacy organization founded by parents of individuals with intellectual and developmental disabilities in 1954.

- Grown annual revenues more than four-fold to $125 million.

- Completed 64 million customer transactions.

- Diverted 1.4 billion pounds of donations from landfills including more than 400 million pounds via 6.2 million curbside pickups.

Beyond the cash flow crisis, however, the situation endangered arc Thrift Stores’ ability to fulfill its mission of enhancing the lives of individuals with intellectual and developmental disabilities.

Scrambling for answers, arc Thrift Stores President and CEO Lloyd Lewis turned to the organization’s longtime banking partner, BOK Financial. Relatively quickly, Chris Haney, Colorado team lead, nonprofit and municipal banking, had arranged for a $12.5 million line of credit (later increased to $14 million) that provided the thrift store operator with the lifeline it needed to weather the storm.

“It was a very uncertain time for us, but Chris and his team were extremely supportive. Due in part to our deep relationship with BOK Financial, we quickly grew confident that we would survive the COVID year,” Lewis said. “Over our 15-year relationship, BOKF has always been there for arc Thrift Stores, providing the advice, support and assistance we’ve needed—whatever that entails—to fulfill our mission.

Recovery steeped by Lewis

arc Thrift Stores opened its first retail site in 1968 on South Broadway in Denver. The store represented the initial fundraising push of a nonprofit entity created to raise money for the Arc Chapters of Colorado, which was founded in 1954 by a group of parents of children with intellectual and developmental disabilities to provide educational, medical, housing and employment support.

"BOK Financial was very helpful as we started to turn the organization around. And all along, over the last 15 years, they’ve been critical to the business.”

Llyod Lewis, arc Thrift Stores President and CEO

By 2005, arc Thrift Stores operated 17 retail sites along Colorado’s Front Range, but a series of missteps led to decelerating sales and an unsustainable cash drain. Lewis, then serving as the CFO of a successful technology firm after previously directing the finances of a publicly traded medical equipment company, was recruited to arc Thrift Stores by a former IBM colleague.

Hired as CFO in May 2005, Lewis was named CEO within six months and began to reverse the organization’s slide. A few years later, Lloyd initiated a relationship with BOK Financial to explore funding options for arc Thrift Stores’ then-ongoing turnaround efforts.

BOK Financial made a tax-exempt $8 million loan that provided the organization with the sound footing it needed to right itself while resolving its lingering issues.

A mutually beneficial friendship

Haney has been BOK Financial’s point person for Lewis and arc Thrift Stores since 2018 after working about five years on the team that supports the relationship. He attributes the strong bank-client connections to an unwavering commitment to transparency and support.

“It may seem basic, but we rely on a lot of open communication with the arc team to always know what they need, what challenges are going on and how we can help them,” Haney said. “Beyond that, we’re regularly providing updates on important topics they should think about, whether it’s fraud prevention, cybersecurity issues, financing or investing strategies—and we’re getting experts in front of them.”

"Of all the amazing things that arc Thrift Stores does, what gets me the most excited is that they give often marginalized people dignity, a sense of purpose and a sense of place.”

Chris Haney, Colorado team lead, nonprofit and municipal banking

Following the initial PPP rejection in 2020, Haney’s team helped arc Thrift Stores secure $9 million in the program’s second round in 2021, and provided essential support when an unexpected obstacle initially blocked the organization’s application for PPP loan forgiveness. Besides those crisis mode solutions, BOK Financial provides arc Thrift Stores with core banking services, investment services, cash management and treasury solutions.

“They’ve been a great partner and supportive entity that has helped us with any issue that we’ve had, and kept us posted on upcoming events and opportunities,” Lewis said. In turn, the exposure to arc Thrift Stores has raised awareness within BOK Financial of a community that is too often dismissed by many.

Well-positioned for the future

Lewis isn’t letting arc Thrift Stores rest on its laurels. Looking to expand beyond the company’s 34 stores across Colorado, Lewis is actively exploring possibilities in other states while targeting between three to five new openings per year. Although each new location holds its own operational and logistical challenges—as well as the unique workplace rules and regulations that the organization will encounter in any new state—he’s thrilled to further expand the impact the organization has on local communities.

"Part of any business success formula is having a good banking partner and we certainly hit the lottery with BOK Financial.”

Llyod Lewis, arc Thrift Stores President and CEO

Most prominently, the stores raise funds that support the advocacy efforts of the 15 Arc Chapters across Colorado. Lewis said the money provided from the proceeds of arc Thrift Stores allows chapter leaders to avoid government program funding that could potentially cloud discussions with state and federal officials. Additionally, arc Thrift Stores proceeds support Ability Connections (formerly Cerebral Palsy Colorado); food drives for Meals on Wheels programs, soup kitchens and food pantries; many Colorado relief agencies; and Colorado flood and fire victims, among others.

“Part of any business’ success formula is having a good banking partner, and we certainly hit the lottery with BOK Financial,” Lewis said. “We’re now in expansion mode with a great opportunity to grow our stores, revenues and earnings, which will provide additional funding for advocacy, support for other nonprofits, and employing people with intellectual and developmental disabilities—and BOK Financial will be critical in supporting that growth.”

"It may seem basic, but we rely on a lot of open communication with the arc team to always know what they need, what challenges are going on and how we can help them.”;

Chris Haney, Colorado team lead, nonprofit and municipal banking

How can a healthy banking relationship be beneficial to a nonprofit organization?

Chris Haney, Colorado team lead, nonprofit and municipal banking

Insights into improved efficiencies

The healthiest nonprofit organizations apply lessons from the for-profit business world, but nonprofit leaders are frequently too busy working to fulfill their mission to identify where improvement is most needed. An experienced banker can help a nonprofit organization’s leaders identify banking efficiencies that allow for it to shift even more resources directly toward their mission. In addition, a bank can offer valuable resources ranging from fraud prevention guidelines to tax-exempt financing for capital projects.

Effective cash management

Every nonprofit organization endures the ups and downs of fundraising. An experienced banker can help smooth the impact of the extremes by providing processes that prioritize covering operating expenses while building up reserves. Plus, an ideal investment blend of growth potential and capital preservation within the reserve account can help provide flexibility into the future.

Thoughtful reserve utilization

Healthy reserves provide a financial cushion that can be especially valuable when fundraising falters or revenues slow. To effectively tap this source of liquidity, an experienced banker can help arrange low-rate financing secured by the cash and investments in the reserves to support the organization during lean times without requiring the liquidation of investments or depletion of cash reserves.

More success stories

See how an extended line of credit helped this multi-generational business grow and expand.

Discover how a revolving line of credit supported MTech for 20+ years of transforming Colorado’s cityscape.

Priority Ambulance needed a solid financial partner to streamline complex collection and payment processes.